TradingView Indicators

RSI

This script is a customized Relative Strength Index (RSI) indicator with added functionality, notably the optional Bollinger Bands overlay.

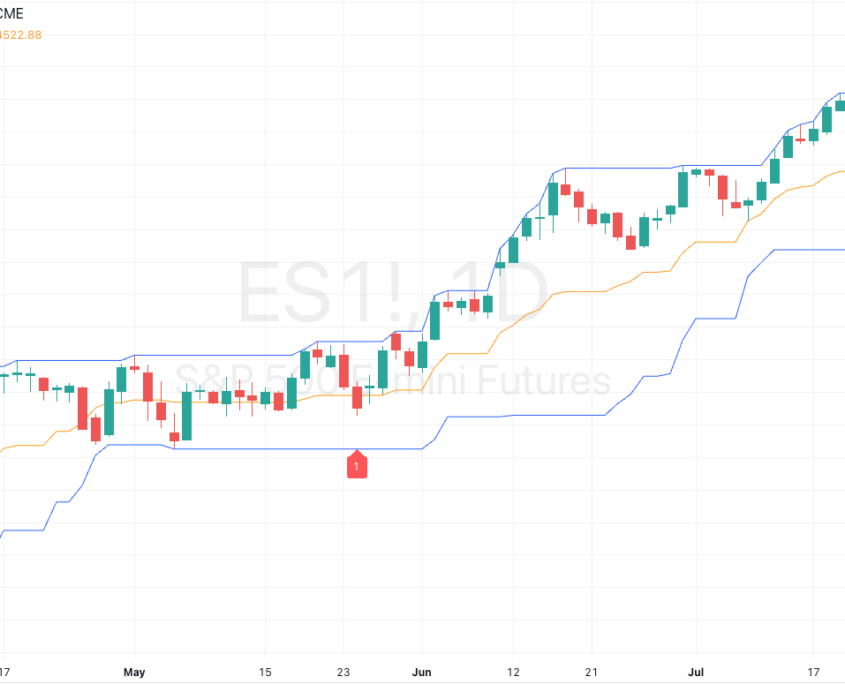

Bars Above/Below Donchian

Provides a visualization of the Donchian Channel and measures the number of bars above and below the middle line of the channel.